Informational Videos

Browse through our animated videos to learn about financial principles that can help you whether you are busy accumulating and growing wealth, getting ready to retire in five to 10 years, or living in retirement now. One of our biggest goals at The Bethesda Group is to educate consumers about financial matters, and we hope these videos help make things clearer.

Decumulation Versus Accumulation

What is an FIA (Fixed Indexed Annuity)?

How Required Minimum Distributions (RMDs) Work

What You Need to Know About Social Security

What Is Medicare?

Portfolio Diversification

Downloadable Whitepapers & Worksheets

It’s our goal to make complex concepts simple to understand so that you can achieve your life’s ambitions. Our whitepapers are designed to help you learn more about the basics when it comes to finance and retirement issues. Please download and review these whitepapers at your leisure, and feel free to contact us if you have any questions about what you’ve read.

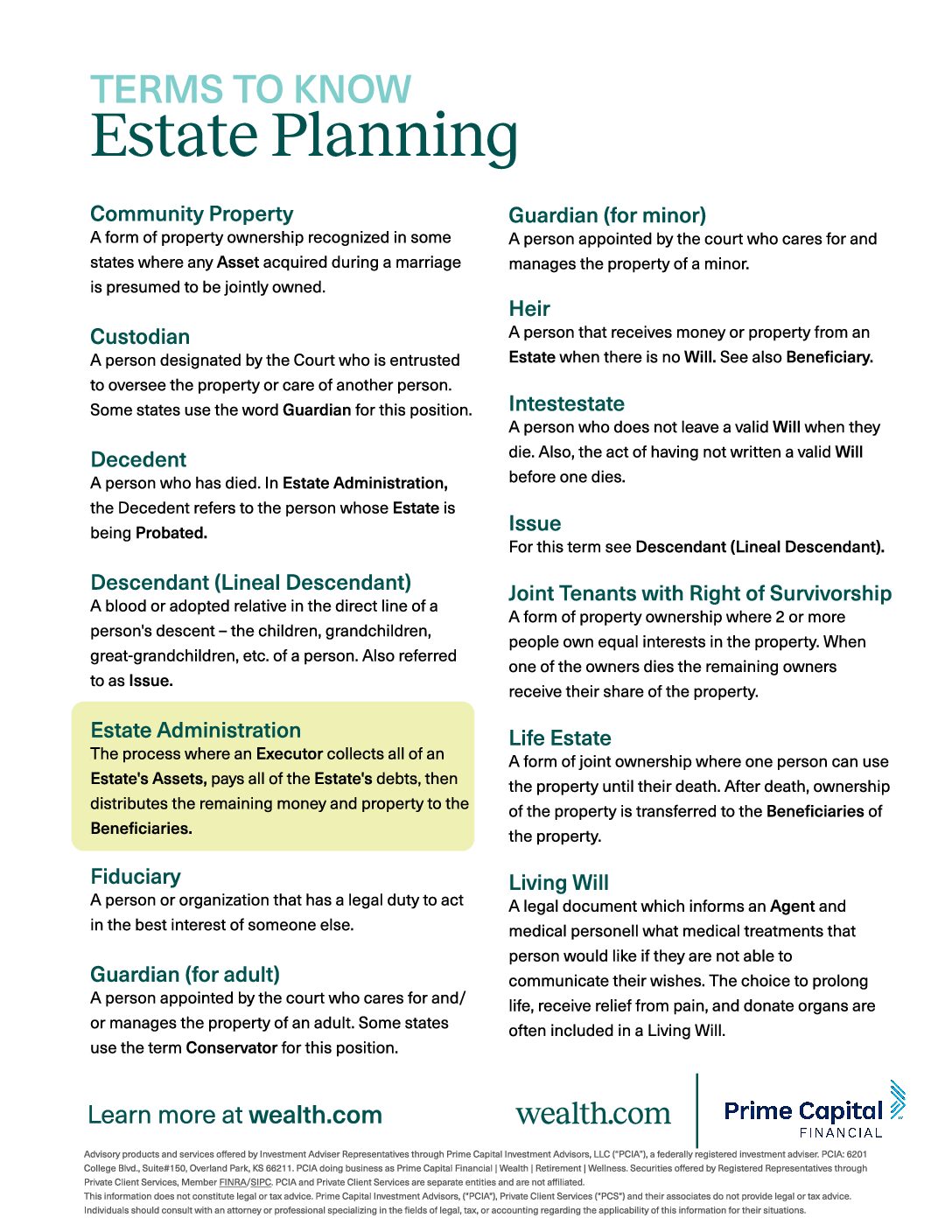

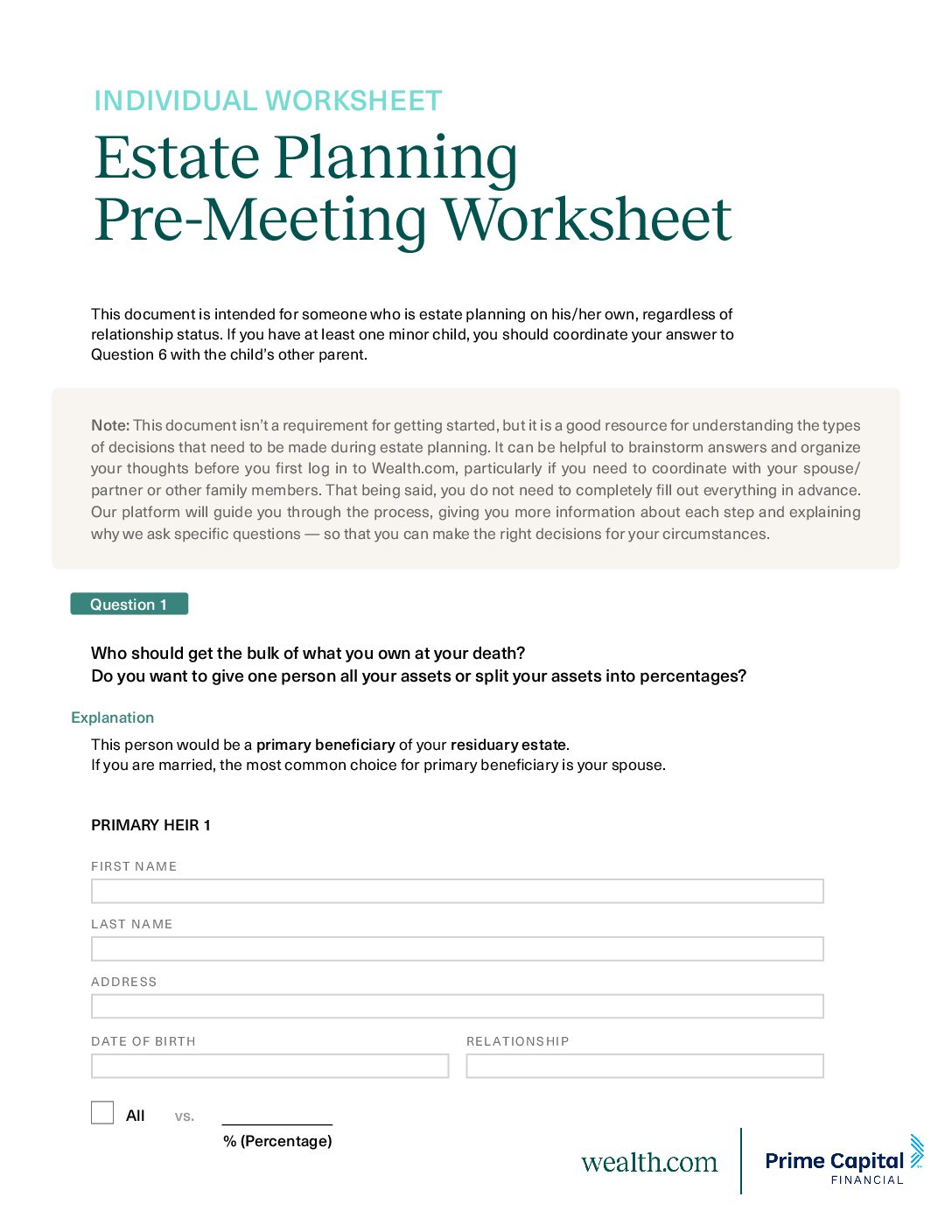

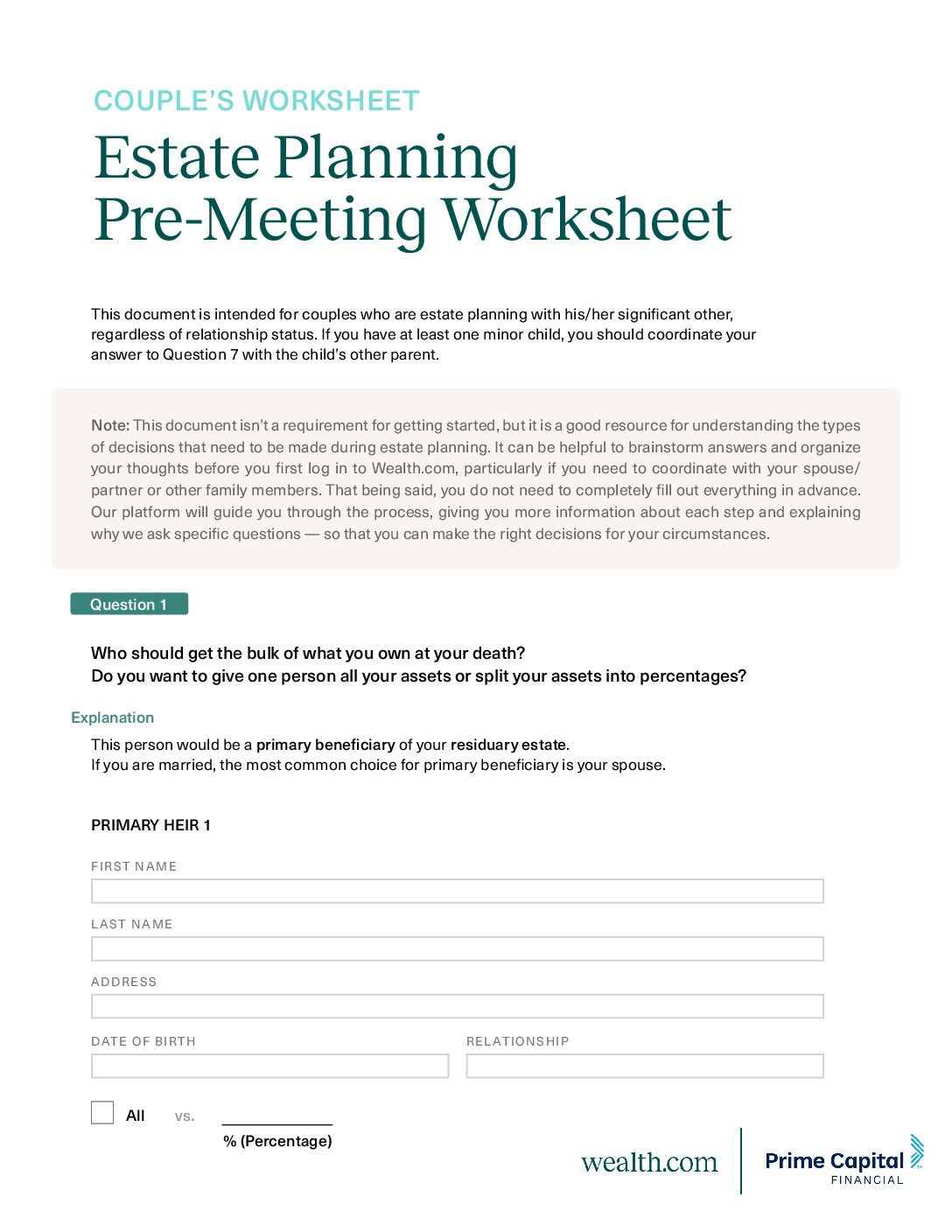

Estate Planning Resources

Tools You

Can Use

At The Bethesda Group, we offer you valuable tools you can use to access information from anywhere. These are provided absolutely free to help you gain a clearer picture about your financial situation, as well as helping you with estate planning and important document storage. If you have any questions about eMoney or Wealth.com, simply contact us for a complimentary discussion!

eMoney

eMoney serves as our trusted account aggregation dashboard, empowering you as a client to monitor not only your investment accounts with us but also the other financial aspects of your life, all available in one convenient platform. Additionally, eMoney offers robust features for budgeting and secure document storage, enhancing your financial management experience.

Wealth.com

Visualize the entire estate planning process

- Visual flowcharts for every plan

- Probatable vs. non-probatable asset breakdowns

- Compare asset ownership with Ownership Balance Sheet

- Understand the impact of estate taxes

Frequently Asked Questions

View some of the most commonly asked questions we get about us, our firm, and our services!

How is a wealth advisor different from a financial advisor?

The terms “wealth advisor” and “financial advisor” are often used interchangeably, but they have distinct differences in scope and services. A financial advisor is a broad term for professionals who help clients manage their money. A wealth advisor is a specialized financial advisor who provides comprehensive wealth management services for high-net-worth individuals, business owners, executives, or families with complex financial needs. This includes in-depth investment management, estate planning, tax strategies, retirement income planning, and financial planning for individuals going through high-net-worth divorce.

How are you compensated?

We are fee-based advisors. We charge a fee for financial planning and investment management, which is deducted from the accounts under management. In some cases, we recommend alternative investments or insurance, where the fee does not come out of assets under management. In those cases, we are compensated based on a commission paid by the company providing the product. We discuss our fees in detail during the first meeting because we prioritize transparency.

What are your qualifications?

The wealth advisors in our group are highly credentialed professionals with extensive experience in financial planning, wealth management, and estate planning. Our team members hold the following designations:

- Certified Financial Planner (CFP®) and Chartered Financial Consultant (ChFC®), can provide a comprehensive financial planning and investment strategies.

- Chartered Life Underwriter (CLU®), specializing in insurance and estate planning.

- Certified Divorce Financial Analyst (CDFA®), allowing them to navigate the financial complexities of divorce.

Additionally, some of our advisors hold advanced degrees, including:

- Juris Doctor (JD), providing a strong foundation in estate planning.

- Master of Business Administration (MBA), equipping them with advanced business and financial management skills.

These diverse qualifications enable us to offer well-rounded, strategic guidance tailored to our clients’ unique financial needs.

Do you work with clients outside of the Maryland/Washington, D.C./Northern Virginia area?

Yes! We work with clients nationwide, providing comprehensive financial planning and wealth management services regardless of location. Through secure virtual meetings, phone consultations, and digital financial tools, we offer the same high level of personalized service to clients across the country. Whether you’re local or in a different state, we are equipped to help you achieve your financial goals.

What is your client asset minimum?

Our client asset minimum is $500,000, which includes all investable assets such as retirement accounts (401(k)s, IRAs), deferred compensation plans, and equity compensation plans. If you’re unsure whether you meet the minimum, we’re happy to discuss your specific situation and explore how we can help.